Defensibility: Revolutions

Part 4: Disruption occurs when “critical" technology makes a new stack “viable”.

This is the fourth in a series of posts dedicated to understanding defensibility in technology-driven markets.

If you’re new, start with the first post and subscribe to be notified as new posts are published.

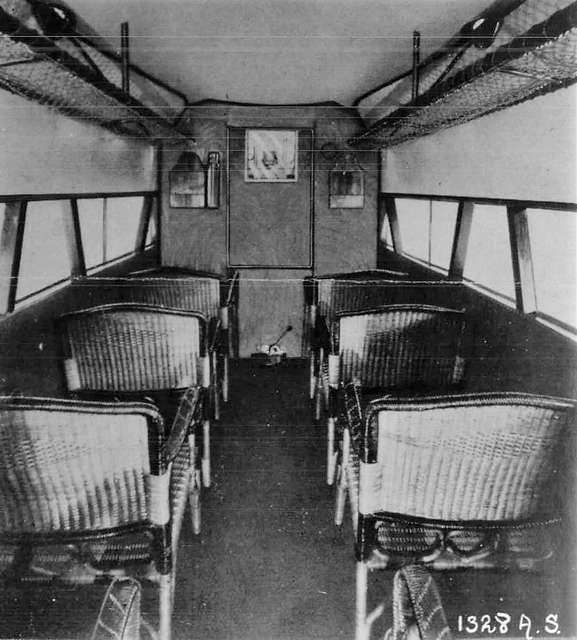

Starting in the late 1920s, Zeppelin carried passengers on intercontinental voyages between Europe, North America, and South America. A journey from Europe to North America that once took 5-7 days on an ocean liner was merely 2-3 days via airship.

Zeppelin of the time comprised a large rigid airframe filled with a lifting gas (hydrogen1). Because they could lift so much weight, these hulking airships were able to carry the powerful, but heavy, internal combustion engines that allowed them to cross the oceans reliably. Many imagined a future where Zeppelin would dominate global passenger travel for some time to come.

In the late 1920s, it was easy to dismiss fixed-wing aircraft given their small and cramped cabins compared to the luxury of the Zeppelin. Why were fixed-wing aircraft cabins so small? The “heavier-than-air” fixed-wing aircraft tech stack at the time comprised a fabric and steel airframe and was restricted to smaller aircraft because engines with sufficient power-to-weight ratios could not be made and reliable or efficient enough for long journeys.

“Critical” technologies are the key drivers of customer satisfaction in a tech stack.

The airship’s reign over the skies was short-lived. By the late 1930s, the fixed-wing tech stack became viable for safe overseas crossings. Engines providing sufficient power-to-weight ratios for larger aircraft became both reliable and efficient enough for overseas flights. In 1938, the piston-powered Boeing 314 could make the transatlantic journey in merely 18-20 hours while transporting its passengers in luxury comparable to airships. Engines were the critical technology for long distance fixed-wing flight—they were the limiting factor for the long-distance airplane transportation market.

Once the fixed-wing distance barrier was overcome, the market shifted rapidly. Even if airships had successfully transitioned to helium or another non-combustible lifting gas after the Hindenburg disaster, few would opt for a multi-day journey on an airship given a much faster alternative. When it comes to travel, faster is better. There’s no speed that’s “good enough”. All of the effort spent making airships safer, more luxurious, and faster just didn’t matter once combustion engines became sufficient for long-distance fixed-wing flight.

Consider another example: Uber and Lyft’s ascension. Uber started out as a simple SMS-based dispatch service for black cars—“please pick me up at 539 Bryant Street”—and was far better than traditional taxis. The typical taxi experience was awful: waiting outside in the rain, hoping an empty cab would pass, or calling a dispatch center only to be told, “if a taxi doesn’t arrive in 30 minutes, call back”. Similar to early aircraft, it was easy to dismiss Uber as “limos for rich people” and not yet viable to replace taxis at scale.

However, the landscape changed rapidly with the advent of smartphones equipped with GPS and high-speed data connectivity. This technology allowed Lyft to build a smartphone-based dispatch product that enabled anyone—not just professional drivers—to pick up riders at much lower prices than taxis or black cars. Uber quickly launched a competitive service, UberX, sparking a revolution in the ground transportation industry. Taxi medallion values crashed and semi-corrupt local regulators were apoplectic. The market transformed overnight as soon as the ride sharing tech stack became viable to better meet customer needs. In this case, GPS and high-speed internet on smartphones were the critical technologies for ride-sharing to thrive.

Improving critical technologies within a tech stack results in evolution, not revolution.

Driven by wartime improvements, airplane engines kept getting better. By 1943, the Lockheed Constellation could complete a transatlantic trip in only 14-15 hours. By the 1950s, the jet-powered Boeing 707 further reduced this time to merely 7-9 hours.

Since then, fixed-wing airplanes have remained the primary method of moving around the planet despite tremendous advancements in virtually every area of technology. Why? No new long-distance travel tech stack has become viable. We’re not (yet) traveling on ballistic rocket flights from San Francisco to Tokyo and there are no under-ocean hyperloops from New York to London.

When no new tech stack becomes viable, but critical technology continues to improve, customer value increases while markets undergo evolutionary rather than revolutionary change. The aircraft industry exemplifies this phenomenon. Manufacturers were able to upgrade engines—transitioning from piston engines to turbojets and eventually turbofans—without fundamentally changing their product lines or business models. Case in point: Boeing’s 7x7 aircraft family remains a dominant player nearly 70 years later. In this evolutionary market, airlines and aircraft manufacturers succeeded or failed based on their ability to provide what people cared about: lower prices (achieved through more efficient engines and larger aircraft with greater passenger capacity) and expanded global coverage.

Looking ahead, the fixed-wing tech stack is likely to see only further evolutionary changes, barring the emergence of a viable new tech stack. Perhaps the electric vertical-take-off-and-landing (EVTOL) tech stack will eventually become viable and disrupt the regional air travel market while ballistic flight disrupts long-distance air travel. However, until these or other new tech stacks prove viable, the aviation market will continue its pattern of gradual, evolutionary progress.

Once a critical technology ceases to impact customer value, it becomes “sufficient”.

Smartphone technology, like aircraft propulsion, advanced tremendously in the first two decades of the 21st century: better screens, faster networks, and desktop-class processors. Uber remained successful despite these advances. Why? Similar to the fixed-wing aircraft industry, no new method of ground transportation reached viability despite rapid advancements in underlying technology. While improvements in smartphones made Uber’s app better looking, snappier and accessible to a global audience, they didn’t meaningfully change how ground transportation services were delivered.

This contrasts with airlines, where engine efficiency improvements continue to significantly impact ticket prices (fuel constitutes a large portion of an airline's variable costs) and overall profitability. As a result, engines have remained a critical component in aviation.

In ride-sharing, however, smartphone technology has mostly stopped mattering. Uber focuses on what customers care about—faster pickups, multiple pricing tiers, scheduled rides, and regulatory liberalization. Faster smartphone processors don’t make a car come faster. Bigger screens don’t make a ride cheaper. Smartphones became “sufficient”—where further advancements no longer improve the product—even though they were once the critical technology for the market.

Disruptive market revolutions occur when critical technology makes a new stack viable.

The concept of the “adjacent possible” suggests that humans can reliably predict the future only one conceptual step at a time. Looking more than one step forward—a future that is no longer adjacent—introduces so many possibilities that uncertainty dominates, making predictions unreliable. Someone might make a lucky guess, but it’s just that: a guess.

When a new technology stack enters the adjacent possible, we can confidently envision how the pieces fit together, even if that future isn’t yet technically achievable. In the case of the Zeppelin, while suitable engines for reliable long-distance flight didn’t yet exist, the fixed-wing tech stack was conceptually understood. A keen observer, noting steady progress in internal combustion engine reliability, efficiency, and power-to-weight ratios, could foresee the Zeppelin’s eventual obsolescence. Early prototypes like the Dornier Do X flying boat with its first flight 1929 hinted at this future even if it wasn’t yet commercially viable.

Today, autonomous vehicles represent the adjacent possible tech stack poised to revolutionize Uber's market. In this case, AI—not the smartphone—is the critical technology driving the autonomous vehicle stack.

While some companies survive such revolutions—Netflix transitioning from DVD-by-mail to streaming is a rare example—most struggle. We can bet that Uber is working hard to retain its marketplace dominance in a post-autonomy world, even though autonomous driving technologies aren’t fully viable outside a few test markets.

Critics of current autonomous driving technology point to expensive lidar units, limited test environments, and overly cautious driving behaviors. That will change. Tesla’s camera-based stack can reduce the cost of vehicles while advancements in AI will enable driving in all conditions (level 5 autonomy) with sufficient assertiveness to navigate complex traffic scenarios like unprotected left turns during rush hour.

Absent regulatory intervention, expect an autonomous driving tech stack revolution soon.

A generalized algorithm for critical and sufficient technologies

To summarize, here are the four ways technology advancement impact markets:

When new stacks delivering superior value enter the “adjacent possible”, revolution looms.

When “critical” technologies make a new stack viable, a disruptive revolution occurs.

Improving critical technologies within an existing tech stack results in evolution, not revolution.

Once technology reaches “sufficiency”, its advancement no longer significantly impacts the market.

When a particular technology is advancing, consider its impact on both current stacks and its potential to make new stacks viable.

For a stack to be viable, it must not only be novel but also deliver superior customer value. To understand if that’s the case, start with psychology. What do customers value? Speed, quality, cost, convenience, adaptability, design, aesthetics, or other factors? Novelty alone doesn’t matter.

If no new stack becomes viable, successful incumbents will incorporate the new technology and continue “surfing the wave.” This explains why it’s challenging to compete with Boeing and Airbus in the aircraft market.

If a new stack becomes viable due to a critical technology, both startups and incumbents must be prepared to “catch a new wave”. Missing the wave is fatal—consider how the taxi industry was blindsided by Uber and Lyft. Incumbents who are aware of the “innovator’s dilemma” may successfully catch a new wave and leverage their existing distribution to beat startups even in the face of a disruptive market revolution. However, much of of the time, incumbents can’t get out of their own way and a new leader emerges.

In the case where there’s only one new tech stack on the horizon with the promise of delivering superior customer value versus an incumbent stack, go! In this “single-wave” scenario, invest in building a great product and then establishing power so we can become the dominant player.

Decisions are harder when multiple alternative stacks are likely to become viable given advancement in their critical technologies. Just as surfers eyeing a set of large waves must decide which to catch, companies must decide which of the soon-to-be-viable tech stacks to build on. Airships, while superior to ocean liners in many ways, ultimately proved to be the wrong wave to catch. We’ll explore how we might face such “multi-wave” scenarios in detail below.

Revolution and evolution in AI

Where AI integrates cleanly into existing products, there will only be evolutionary change to today’s tech stacks. When users seamlessly transition from non-AI to AI-powered workflows, strong incumbents are likely to remain winners by relying on greater distribution and accumulated structural power. Photoshop added AI painting features without disrupting their interface. Gmail cleanly integrated AI email drafting features. Startups in these markets are likely only to succeed when incumbents execute really poorly (which does happen frequently, e.g. WhatsApp vs. SMS, Dropbox vs. prior file sharing vendors, GitHub vs. other version control systems, Zoom vs. Webex).

When AI-powered interactions necessitate totally new user interfaces, expect incumbents to proceed slowly. Longtime customers typically resist major user experience changes. Professionals have spent decades turning Bloomberg, Photoshop, and Microsoft Excel into extensions of their own bodies. They’ll be understandably upset if that investment were to become irrelevant. Predictably, incumbents are often unwilling to infuriate their customer base (and throw away their power of lock in) by releasing a totally new UX. Similarly, “systems of record” for Sales, Marketing, Finance, HR, Legal, Supply chain, and other departments were built atop manual workflows as an upgrade to offline paper processes. Enterprises made huge investments building these workflows, so incumbents are unlikely to want to rock the boat.

When incumbents move slowly, revolutions are likely. When AI enables new disruptive stacks (e.g. ChatGPT, AlphaFold, humanoid robots, enterprise agents), new products can provide far more customer value than legacy products. While hypothetically startups and incumbents could both build these disruptive new products, incumbents are often so afraid of cannibalizing their existing business that they avoid moving until it’s too late. Startups are unencumbered by the past and can move at warp speed.

Regardless of whether AI is revolutionary or evolutionary today, companies large and small must watch out for additional waves of disruption in the future. Will an incumbent be able to maintain their leadership amidst continued AI progress? Will a startup that wins in a first wave of disruption be disrupted by a future wave? To answer these questions, we can rephrase them as: “If we had true superhuman AGI, would we still deliver customer value in the same way?” In other words, what might a “GPT-8” or “Llama 7” world look like?

In markets with only one wave to catch, we expect a first wave of disruption where future AI progress causes only evolutionary change. Winners in the current generation of AI disruption will be able to surf for quite some time and we’re pretty sure that even superhuman AGI won’t change how they deliver value.

These “single-wave” markets are likely when customer requirements remain fixed. When AI directly impacts customer satisfaction—it is critical technology—but future advancement integrates cleanly into products, it won’t disrupt the status quo. Future products might become faster and cheaper, but the stack otherwise stays the same.

With fixed requirements, AI will eventually become sufficient for the use case, with its advancement no longer impacting customer satisfaction. For example, in manufacturing automation‚ the core job to be done is a set of manufacturing steps. While superhuman AGI might execute these steps faster, cheaper, using universal hardware, or with less programming, the fundamental goal remains the same. The first wave of AI manufacturing will be disruptive, but subsequent progress will be evolutionary, eventually reaching sufficiency.

With only one wave to catch, our time-on-wave is long and traditional startup wisdom applies: we can start by relentlessly delivering value to customers. A “10x” product is a viable strategy so long as a startup can maintain its lead. Startups with true execution power can win, particularly if they stay outside of big tech’s blast radius. If a company has execution power and they successfully surf a wave with no new tech stacks on the horizon, they can afford to start building structural power. Uber had a very long time between smartphone-led disruption and the current wave of disruption from autonomy. They were able to get to massive scale before having to worry about subsequent waves of disruption.

“Multi-wave” markets occur when more than one disruptive technology revolution occurs in short succession. Companies in multi-wave markets will still be grappling with a first wave of disruption when another rudely hits them. Zeppelin were still in their infancy attempting to disrupt sea travel when fixed-wing aircraft overtook them. It’s easy to imagine an alternative history where Zeppelin dominated air travel for decades—well-known airship brands with terminals in every city. If long-distance fixed-wing aircraft arrived after the airship industry matured, incumbents may have been able to use their capital, terminal infrastructure, and brand recognition to win in the fixed-wing aircraft market. But that didn’t happen. Fixed-wing aircraft became viable long before Zeppelin got to scale—death by a multi-wave market.

Whenever progress in AI repeatedly changes how humans interact with software, multi-wave markets are likely. Knowledge work, for instance, has an almost infinite demand for expanding scope and capability. Today’s narrow, task-specific AI co-pilots help humans run existing workflows. Co-pilots are likely to be wholly replaced when human-equivalent AI agents become possible to fully automate these workflows. Agents, in turn, may be superseded when superhuman AGI manages entire departments. Each improvement in AI changes customer requirements and expectations, opening the door for new revolutionary tech stacks.

Multi-wave markets are also likely when the availability of intelligence increases the demand for intelligence: “induced demand”. Each time companies dream up new AI-enabled products, the adjacent possible expands. Customers want to solve problems they didn’t think could be solved before. By the time we get to superhuman AGI, markets might exist for products that are unfathomable today.

When AI-enabled law firms make contract law more efficient, we’ll probably have more and longer contracts with new ways of utilizing legal services. Once we have a humanoid robot cleaning the house, we’ll want a robotic butler at our beck and call. When most of our marketing collateral is AI-generated, we’ll want campaigns entirely personalized for each prospective customer while remaining consistent with our brand. When models can predict protein structure, biologists will want to predict protein-protein interaction, then model cells as a whole with an eye towards designing biological machines the way we currently design mechanical machines. Each major increase in demand for intelligence opens the door for new tech stacks to satisfy that demand.

Multi-wave markets are riskier than single-wave markets because long term success requires successful navigation of multiple disruptive technology shifts. Unlike the past, where mature companies had years to navigate a given wave of disruption, AI requires even immature companies to grapple with multiple cascading waves of disruption coming at them at once.

How should founders and investors deal with multi-wave markets? This is the most important strategic question for many AI companies today that we’ll address in the next post.

Defensibility

A series of posts dedicated to answer the question: Where will value accrue in AI?

"Execution power” is becoming more important than classical “structural power”.

Market revolutions occur when “critical" technology makes a new stack “viable”.

When multiple stacks become viable in rapid succession, companies must “AND” or “OR”.

Power within the AI stack—hardware, hosting, models, and infrastructure.

Power in AI applications—big tech, switching costs, network effects, and the $100 trillion of global GDP up for grabs

In retrospect, this turned out to be a poor choice.